Everything banks need to know about the new EBA Regulations and Regulatory Technical Standards on Interest Rate and Credit Spread Risk in the Banking Book (IRRBB and CSRBB). Discover the changes, additions, implications, and how ADC can help.

The new EBA Guidelines

What are implications of the end of the consultation period?

On April 4, 2022, the consultation for the new Draft EBA Guidelines (“the Guidelines”) on the management of interest rate and credit spread risk arising from non-trading activities (also called: banking book) ended. The new Guidelines will replace the guidelines from 2018. At the same time, the consultation for two new Draft Regulatory Technical Standards (RTSs) ended as well. The two RTSs are comprised of:

- The RTS SA that specifies a standardised approach and simplified standardised methodologies to evaluate the risks arising from potential changes in interest rates that affect both the economic value of equity and the net interest income of an institution’s non-trading book activities, and

- The RTS SOT that specifies shock scenarios, common modelling, and parametric assumptions for the Supervisory Outlier Test (SOT), as well as what constitutes a large decline for the calculation of the economic value of equity and of the net interest income in a shock scenario.

Important New Elements

This is important news for several key players, including chief financial officers; chief risk officers; balance sheet and asset liability managers; financial risk managers and model developers; and validation teams at banks. The most important new elements in the new EBA Guidelines and the two RTSs are as follows.

- Banks must prove that they are fully compliant with the Guidelines; otherwise, they run the risk of having to implement the Standardised Approach to evaluate and measure the interest rate risk in the banking book. This would be an additional operational burden.

- The Supervisory Outlier Test (SOT) was moved from the 2018 EBA Guidelines to the RTS SOT. It has been extended with a SOT on the impact of stress scenarios on the Net Interest Income (NII). As a result, there will be two SOTs: one on the economic value of equity (EVE) and one on the net interest income (NII).

- The new SOT on NII has specific requirements, for example, on the way the balance sheet is projected, including assumptions on new production and the use of commercial margins in the projection. This can differ from the way banks measure NII-at-risk in their internal risk management systems.

- The Guidelines now include a separate section on Credit Spread Risk in the banking book (CRSBB). The most interesting aspect is that no assets are excluded ex-ante from the perimeter of the CSRBB assessment, thus banks must make their own assessments on scope.

Important Elements Unchanged

The “risk-free” rate discounting methodology for the SOT EVE, introduced with the 2018 EBA Guidelines, still applies. Consequently, the inconvenience between economic and regulatory valuation, as well as the consequence on risk measurement and hedging remains. This is of course a missed opportunity with the release of the new (draft) Guidelines.

What should banks pay attention to?

Splitting the linear and non-linear risk in behavioural models

Most banks have quite sophisticated Asset Liability Management (ALM) systems in place that measure interest rate risk. Specifically for retail banks, the crucial parts of these systems are the behavioural models for prepayment risk in mortgage loans and the modelling of cash flows for the non-maturing deposits. These non-maturing deposits are variable rate savings and current accounts. The new draft EBA Guidelines still place a lot of emphasis on how to deal with these models. It is important that the bank’s models can split the gap risk (linear) and the option risk (non-linear) in the assessment of interest rate risk.

New list of non-satisfactory criteria

The EBA Guidelines also introduced a new set of compliance criteria. Section 4.4 contains a list of criteria that renders banks non-satisfactory with the Guidelines. A summary of this list is as follows.

- High Level Principle: If IRRBB Guidelines are non-compliant.

- Specific Cases: If banks cannot measure material exposures including gap (linear), option (non-linear), and basis risk.

- Control and Governance: If control and validation measures are not implemented optimally, and if the governance is not implemented in satisfactory manner. Governance in this context is the workings of the ALM committee in embedding the IRRBB risk appetite and risk mitigation in the overall strategy of the bank.

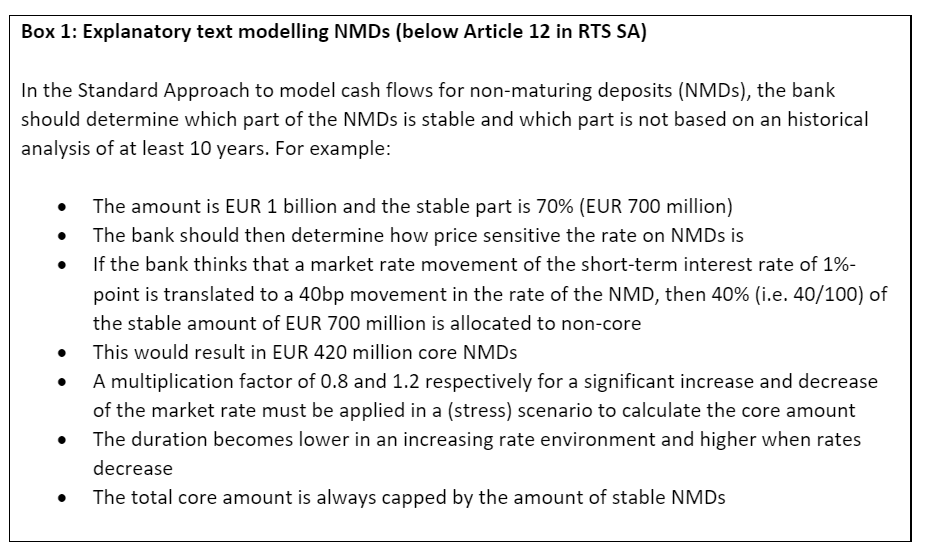

If banks have a non-satisfactory IRRBB system, then the risk is that they must implement the Standardised Approach as laid down in the RTS SA. Moreover, a notable element of the RTS SA is that it contains a methodology on how to model non-maturity deposits (refer to Box 1 below). The standardised approach can differ substantially from the bank’s internal approach; therefore, having major implications on, for example, the interest rate risk strategy and the hedging policy of the bank.

Standard methodologies in the RTS SA

The standard methodologies in the RTS SA are as follows.

- Standardised cash flow buckets and mapping to midpoints apply. In total, there will be 19 buckets in the standardised approach.

- The construction of curves and discount rates in the calculation of EVE.

- An automatic optional add-on, including a 25%-point increase of volatility in stress scenarios.

- Requirements on how to calculate the Net Interest Income.

Requirements on how to calculate the Net Interest Income

The requirements on how to calculate the NII include:

- Use of constant balance sheet projection

- Use of forward rate to reprice cash flows

- Use of commercial margins based on recent transactions

- Maturity of repriced cash flows should be the same as the original maturing cash flows

- Market value changes of instruments should be accounted for on fair value basis (IFRS)

- Same as for EVE: in stress-scenarios, option volatility should be stressed (so called “volatility add-on”), which is relevant for instruments with embedded options at fair value in the bank’s P&L

Requirements on how to calculate the Supervisory Outlier Test

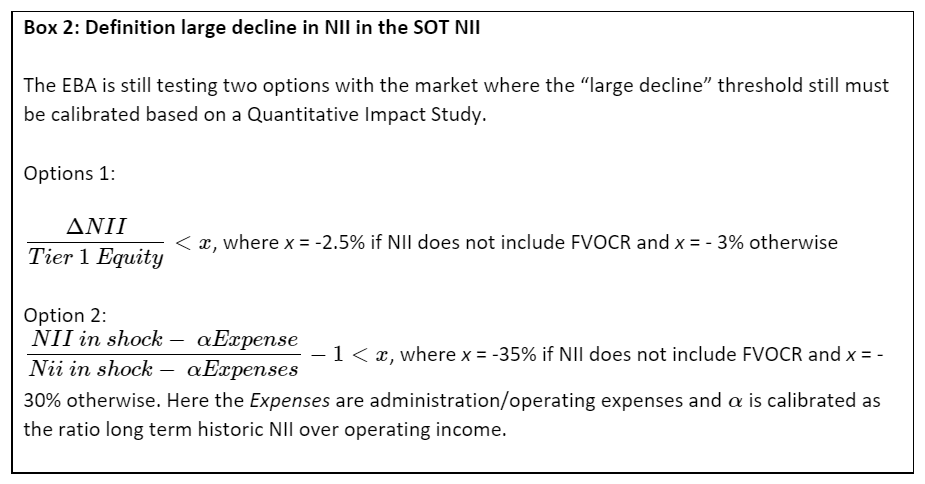

The requirements on how to implement the SOT are described in the RST SOT. A new element is that banks must implement a SOT for NII-at-risk. The requirements on how to measure NII-at-risk are aligned with the aforementioned requirements in the RTS SA. Banks should pay attention to how to treat Fair Value changes in Other Comprehensive Income (OCI) in the NII measurement (refer to Paragraph 27(e) in the EBA Guidelines). The threshold of when to report a “large decline” in NII through the SOT calculation still must be calibrated. The EBA contemplates two options as described in Box 2 below.

New Section: Credit Spread Risk in the Banking Book

The most important change compared to the 2018 Guidelines is the new section of Credit Spread Risk in the Banking Book (CSRBB). The EBA does not exclude any assets from the measurement of credit spread risk. Refer to the explanatory box in Section 4.6.2 in the EBA Guidelines:

“Institutions should analyse their banking book and identify the instruments sensitive to credit spread risk (i.e. no presumptive exclusions). The EBA expects institutions to consider generally all items irrespective of their accounting category ex-ante. As a minimum requirement, institutions should always include fair-value items in their CSR assessment and monitoring perimeter.”

Most important consequences of the new Guidelines for banks

Two of the most important consequences of the new EBA Guidelines that banks should be aware of are:

- the new earnings or NII-at-risk calculations in the Supervisory Outlier Test (SOT), and

- the implementation of Credit Spread Risk in the Bank Book (CSRBB).

NII-at-risk calculations in the SOT

For the NII SOT, most of the work for banks involves seeing if the current NII-at-risk models are compliant with all the requirements laid down in the RST SOT. Another complication can arise in terms of decision-making if the SOT for NII exceeds the “large decline” threshold, and the SOT model differs substantially from the model used for internal management steering. Any difference between a standard and internal approach results in the question: “Which approach is leading in strategy setting for IRRBB, hedging and decision-making?”

Implementation of Credit Spread Risk in the Bank Book

The CSRBB is the most controversial element of the new EBA Guidelines. Since banks are already heavily regulated on the measurement of credit (default) risk, the overall fear is the potential double counting of credit risk related to, for example, loan exposures. On May 8, 2021, the European Banking Federation published a position paper on the interpretation of the CRSBB. One of the most important conclusions of the paper is that assets, such as mortgage loans, which are held for maturity do not fall under the scope of the CRSBB measurement, since all the risk is covered in the measurement of credit risk under Pillar 1.

The use of the risk-free discounting in the EVE SOT is still a controversial element that the new EBA Guidelines inherited from the 2018 Guidelines. The EBA strives for a standardised use of discount rates in the SOT, but in practice they accept that the problem of “non comparable results” shifts to the varying methodologies that different banks use for the so-called stripping of cash flows. Apart from the fact that the risk-free rate and cash flow stripping methodology is not aligned with market prices, the method can have a serious impact on the hedging policy of a bank. The hedging decision is often based on accepting earnings volatility versus EVE volatility.

In addition, this phenomenon was extensively discussed in a roundatable organised by Amsterdam Data Collective in July 2021 with ALM experts from Knab, Nationale-Nederlanden Bank, Achmea Bank and Triodos.

Calculating IRRBB exposures using the standardised approach

An additional major impact will arise if banks are required to calculate IRRBB exposures using the standardised approach. Most of the replicating portfolio models used by banks in The Netherlands are significantly different and more sophisticated compared to the approach previously outlined (refer back to Box 1). This difference once again results in the question: “Which approach is leading in hedging and decision-making?” Typically, it is the economically sensible approach that prevails.

Next steps for the EBA

The EBA will finalise the draft Guidelines and the two RTSs in the summer of 2022, including a final endorsement by the EBA Board of Supervision. It will then be published and submitted to the EU Commission later this year.

How can ADC help?

Our team at Amsterdam Data Collective can help your organisation adapt to the new EBA Guidelines through various methods:

- Compliance gap analysis

- Implementation and compliance with the new Guidelines and RST SOT

- Analysis and documentation of the scope of CSRBB

- Model validation

Let's shape the future

Would you like to know more about the new Guidelines or what ADC can do for you? Get in touch with Scott Bush or check our contact page.

What stage is your organisation in on its data-driven journey?

Discover your data maturity stage. Take our Data Maturity Assessment to find out and gain valuable insights into your organisation’s data practices.